It became common to see $4.00 per gallon gasoline at the pumps. This is the river we crossed:

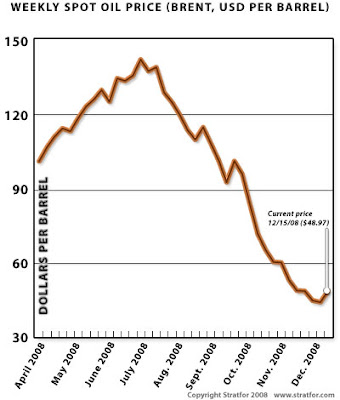

It became common to see $4.00 per gallon gasoline at the pumps. This is the river we crossed: It is the Rubicon in Northern Italy. This is close to where Caesar crossed uttering "the die is cast." Republican Rome was about to die. The first hint that we had emotionally crossed was the "Drill Here, Drill Now" movement. This is a good thing. Energy self sufficiency is something we will need as a strategic necessity if we are to survive as some form of nation state. Sadly, some of that verve has ebbed as gas prices have done this:

It is the Rubicon in Northern Italy. This is close to where Caesar crossed uttering "the die is cast." Republican Rome was about to die. The first hint that we had emotionally crossed was the "Drill Here, Drill Now" movement. This is a good thing. Energy self sufficiency is something we will need as a strategic necessity if we are to survive as some form of nation state. Sadly, some of that verve has ebbed as gas prices have done this:

But the trauma of filling up an SUV for $100+ has not gone away. I submit it was the opening round of the fear that has gripped this economy. This was a defining cultural moment. A society built on consumerism and easy credit can not long stand. When Harry swiped his Discover card to buy the gas for the Jimmy at the Exxon station and got home to see Sally that night, a gnawing feeling was in his gut. They pulled out their credit card statements, their mortgage note and second mortgage (that they got the great rate on for the new deck and grill area!). They gathered up the car loans, insurance costs and pending school costs for Jimmy and Kelly, their iPodded kids. What they suddenly realized was that the mental math they had been using to convince themselves they were OK was wrong. They were living well beyond their means in their 3,800 square foot house in Burbia, USA. They saw this in the Washington Post:

Americans have been living in a financial wonderworld for at least the last twenty years. We have a generation that has grown up on the notion that if you get in trouble, you apply for another credit card. When I graduated from college in 1980, there were no credit cards available for young Naval Officers with a real job. My first credit card was an American Express that I applied for after I made Lieutenant Junior Grade. It came with the stern warning that balances were to be paid off "in full each month to establish your credit worthiness." My how far we have come! Up until a couple of months ago, I could keep shredders going 24/7 at the office and at home trying to destroy the credit card offers and I would barely keep up. Here's my contribution to the World Series Parade:

Now those offers are coming in slower than Obama's response to the Blago scandal.

Now those offers are coming in slower than Obama's response to the Blago scandal.

To a great degree, large parts of our economy have been built on shaky ground. A consumer economy without a diverse jobs base (manufacturing, services, agriculture, etc.) can not long stand. I still believe that, other than the last 60 days, the lowest point of the Bush presidency is when he told us, in the wake of the economy buckling post 9/11, to go out and spend! We were/are at war and war requires sacrifice. But an economy built on consumer spending complicated by the securitization of all that debt has a round chambered and pointed at the middle of the forehead. When the notes of people who can't afford thier houses are packaged and sold to investors who expect an annuity-like return, there's gonna be catastrophic failure. There has been. And the worst is yet to come.

There are more shoes to drop. The multiplier effect of money being spent in the economy is taught in Econ 100 classes as standard fare. When I studied economics in the late '70's we were told that for every $1 spent, there was a $12 impact on the economy because of the "multiplier effect." That was long before the Gucci clad geniuses started increasing the multiplier through complex financial...err, "gadgets?" I spoke to a classmate of mine that was with Wachovia Securities just before the crash in mid-September. Candidly, and he's a reader of these posts, he sounded panicked. They were working through some of the tranches of bad paper. "There are more than 6,400 'strips' in some of these things, we have no idea what we are looking at," he said. A "strip" could be something like Harry's mortgage, Sally's car note, my Visa bill, a piece of permanent financing on an apartment complex in Meridian, Mississippi and God knows how many bad mortgages courtesy of Fannie and Freddie.

Well, the multiplier effect works in reverse too, but with very real and damaging consequences...here comes that shoe! At an Urban Land Institute meeting I recently attended, the outlook was as dreary as four days of Nashville gloom we are currently enduring. The best guesses point to a scenario that says after dismal Holiday sales, a number of retailers are going to go "four paws up." As stores go dark, strip-centers and malls can no longer service their debt due to the drop in rents. The financial institutions get hit again. And it gets worse...the growing job losses will soon have an impact on "good" mortgages too. This is especially true in a world where $2.8 trillion has been lost from the peak cumulative value of American housing...that's $2,800,000,000,000! Well, if your loan is $250,000 and your house is now worth $150,000...what do you do? Send the bank the keys and go start a new life. In other words, the "bottom" is probably 8-10 months away still.

And what will the marvelous "bail out" have accomplished? Honestly, not much. We will have nationalized a large part of our banking system...we have practically nationalized housing already; we the taxpayer will own Detroit...yippee! America, here's what's in your investment account now:

There's a better than 70% chance that we will be well on the way to nationalizing our healthcare system. All for our good. Melville was so right:

The bridges we will build to this new economy will be stronger because of the fire we will have passed through to get the will to do it.

To the green light...

Rumble on!

The average household debt is now $117,951. This breaks down to an average credit card debt of $8,565, vehicle and tuition loan debt of $14,414, home equity loan debt of $10,062 and mortgage debt of $84,911.

Americans have been living in a financial wonderworld for at least the last twenty years. We have a generation that has grown up on the notion that if you get in trouble, you apply for another credit card. When I graduated from college in 1980, there were no credit cards available for young Naval Officers with a real job. My first credit card was an American Express that I applied for after I made Lieutenant Junior Grade. It came with the stern warning that balances were to be paid off "in full each month to establish your credit worthiness." My how far we have come! Up until a couple of months ago, I could keep shredders going 24/7 at the office and at home trying to destroy the credit card offers and I would barely keep up. Here's my contribution to the World Series Parade:

Now those offers are coming in slower than Obama's response to the Blago scandal.

Now those offers are coming in slower than Obama's response to the Blago scandal.To a great degree, large parts of our economy have been built on shaky ground. A consumer economy without a diverse jobs base (manufacturing, services, agriculture, etc.) can not long stand. I still believe that, other than the last 60 days, the lowest point of the Bush presidency is when he told us, in the wake of the economy buckling post 9/11, to go out and spend! We were/are at war and war requires sacrifice. But an economy built on consumer spending complicated by the securitization of all that debt has a round chambered and pointed at the middle of the forehead. When the notes of people who can't afford thier houses are packaged and sold to investors who expect an annuity-like return, there's gonna be catastrophic failure. There has been. And the worst is yet to come.

There are more shoes to drop. The multiplier effect of money being spent in the economy is taught in Econ 100 classes as standard fare. When I studied economics in the late '70's we were told that for every $1 spent, there was a $12 impact on the economy because of the "multiplier effect." That was long before the Gucci clad geniuses started increasing the multiplier through complex financial...err, "gadgets?" I spoke to a classmate of mine that was with Wachovia Securities just before the crash in mid-September. Candidly, and he's a reader of these posts, he sounded panicked. They were working through some of the tranches of bad paper. "There are more than 6,400 'strips' in some of these things, we have no idea what we are looking at," he said. A "strip" could be something like Harry's mortgage, Sally's car note, my Visa bill, a piece of permanent financing on an apartment complex in Meridian, Mississippi and God knows how many bad mortgages courtesy of Fannie and Freddie.

Well, the multiplier effect works in reverse too, but with very real and damaging consequences...here comes that shoe! At an Urban Land Institute meeting I recently attended, the outlook was as dreary as four days of Nashville gloom we are currently enduring. The best guesses point to a scenario that says after dismal Holiday sales, a number of retailers are going to go "four paws up." As stores go dark, strip-centers and malls can no longer service their debt due to the drop in rents. The financial institutions get hit again. And it gets worse...the growing job losses will soon have an impact on "good" mortgages too. This is especially true in a world where $2.8 trillion has been lost from the peak cumulative value of American housing...that's $2,800,000,000,000! Well, if your loan is $250,000 and your house is now worth $150,000...what do you do? Send the bank the keys and go start a new life. In other words, the "bottom" is probably 8-10 months away still.

And what will the marvelous "bail out" have accomplished? Honestly, not much. We will have nationalized a large part of our banking system...we have practically nationalized housing already; we the taxpayer will own Detroit...yippee! America, here's what's in your investment account now:

There's a better than 70% chance that we will be well on the way to nationalizing our healthcare system. All for our good. Melville was so right:

Power unanointed may come -But all shall not be lost. For as grim a picture as I have painted, I would still rather be here than say Rwanda, or Mexico, or China, Russia, India, France, Germany, England...OK, anyplace else. I am like Gatsby:

Dominion (unsought by the free)

And the Iron Dome,

Stronger for stress and strain,

Fling her huge shadow athwart the main;

But the Founders' dream shall flee.

Gatsby believed in the green light, the orgastic future that year by year recedes before us. It eluded us then, but that's no matter—tomorrow we will run faster, stretch out our arms farther. . . . And then one fine morning—I see a revolution ahead. We are going to continue this experiment with socialism, the love affair with the Obamessiah will go on un-checked for a few months. But, as in times of struggle in our past, reality will come anew. We will try a revolutionary concept called "capitalism." Capitalism will be properly monitored, but not regulated to encourage political ends. We will be smarter about how we take care of our own job base and approach the world seeking equality along with fairness in our openness to trade. I expect that our entire tax system will be replaced. We will become more realistic. We may realize that we don't need the 3,800 square foot house for a family of four. The old 2,400 square foot ranch model from the 1950's might work just fine. We will keep our cars longer. A lot of us will pass on early retirement. But we will also vote those that got us into this mess out of office...Americans don't mind taking a little pain. They mind it a lot when they are taking all the pain while the criminals in Washington rack up nice pension plans and health benefits. Along the way we will rediscover the spirit that made us great. It is rugged self-reliant individualism. It's not diversity...it's not levelling the playing field to the lowest common denominator. This is not a sissy nation that needs to turn to Mama Government anytime there's a problem. We're doing it right now, but it will not work. It will fail and when it does, we will remember that we are a restless people and in the words of T.S. Eliot:

So we beat on, boats against the current, borne back ceaselessly into the past.

We shall not cease from exploration

And the end of all our exploring

Will be to arrive where we started

And know the place for the first time.

The bridges we will build to this new economy will be stronger because of the fire we will have passed through to get the will to do it.

To the green light...

Rumble on!